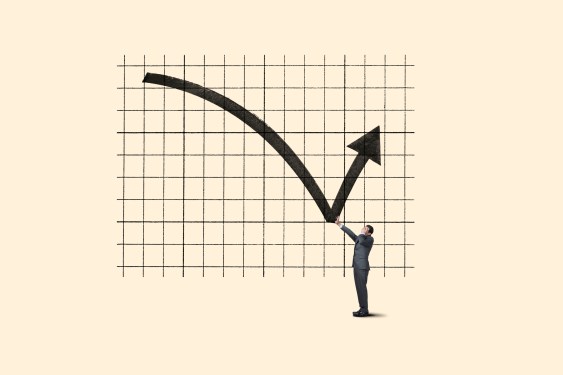

For the past year, everyone’s been predicting that the muted exit environment and bone-dry funding market would bring a reckoning for many late-stage companies. We’ve been seeing layoffs and cost-cutting measures across the board as companies look to shore up their balance sheets. And now, an increasing number of companies are raising money at lower valuations than their last investment. Unfortunately for startups, it seems these down rounds are here to stay.

The Rise of Down Rounds

Earlier this week, Alex Wilhelm dove into Q1 data from Carta, which showed that the number of down rounds had nearly quadrupled in Q1 2023 compared to the same time last year. Down rounds carry a negative connotation and are often interpreted as the fault of the company or founder. But in a market where everything seems to be heading downward, they shouldn’t imply a company or its founders made a mistake – you often simply can’t help it.

To VCs’ credit, many investors have been vocal over the last year about how companies shouldn’t give in to this stigma. This market cycle hasn’t seen a company raise a down round ahead of a successful exit yet, but startups contemplating that possibility should take heart because companies have overcome this hurdle in the past.

Meta and E Ink: Success Stories

Meta, known as Facebook at the time, is probably the best-known example. The social media company had raised a down round in 2009 before it went public in 2012 at a $104 billion valuation. But it might be hard for a B2B sales startup to gain confidence from Meta’s story – the social media company has always seemed to operate in its own world.

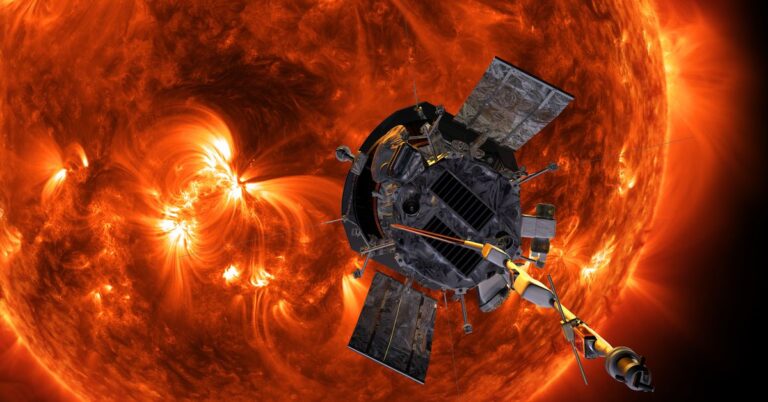

However, there’s one company’s story that might be easier to relate to: E Ink. For those unfamiliar, E Ink was founded in an MIT lab in 1997 and is the company that invented electronic paper, the tech widely used for displays in e-book readers like the Kindle, digital signage, smartwatches, and electronic labels.

E Ink’s co-founder Russ Wilcox, currently a partner at Pillar VC, recently hopped on TechCrunch’s Found podcast to talk about building E Ink and how he became a VC years later. One facet of the story that seemed particularly relevant today was how E Ink navigated its way to an exit through multiple down rounds.

Wilcox’s Perspective

"Yeah, we had three down rounds in a row," Wilcox said. "As you can just imagine, it was a tough time for us. But looking back, I think those down rounds were actually a sign of confidence from our investors." Wilcox believes that the down rounds were a result of E Ink’s innovative technology and its potential to disrupt the market.

"We had a great product, but we didn’t have a clear path to profitability," Wilcox explained. "Our investors saw the potential, but they also knew it was going to take time and money to get there."

Lessons from E Ink

So what can startups learn from E Ink’s experience? Firstly, down rounds are not the end of the world. In fact, they can be a sign that your company has potential and is worth investing in.

Secondly, don’t give up on your vision just because you’re facing financial challenges. E Ink’s founders didn’t throw in the towel when faced with multiple down rounds – instead, they used them as an opportunity to refocus and come back stronger.

Finally, communication is key. Wilcox credits his investors for their support during tough times, saying that they were "very understanding" of the company’s challenges.

Conclusion

Down rounds may seem like a bad omen for startups, but they can actually be a sign of confidence from your investors. By learning from companies like E Ink and taking a step back to re-evaluate your vision and strategy, you can turn down rounds into opportunities for growth.

As the market continues to evolve and funding becomes scarce, it’s essential to stay flexible and adapt to changing circumstances. With the right mindset and support from your investors, even down rounds can be a stepping stone towards success.